Payroll calculator 2019

For example if an employee makes 25 per hour and. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information.

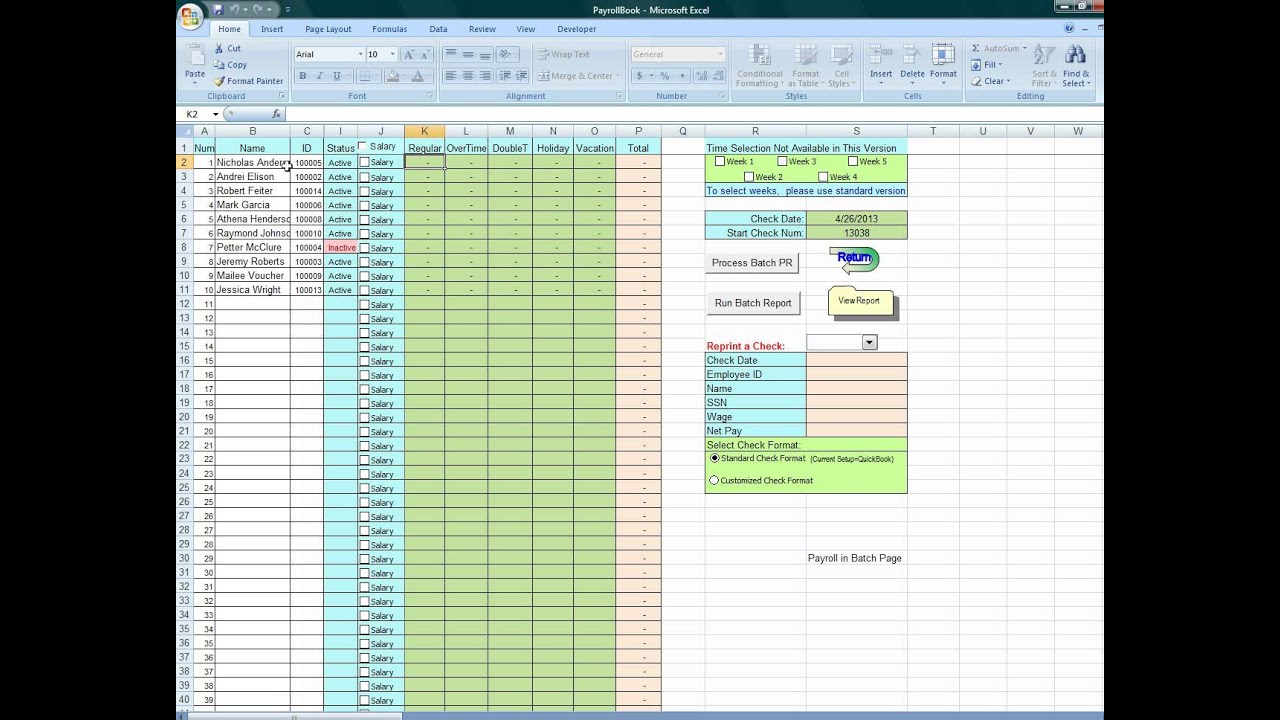

Using Excel To Process Payroll Dyi Excel Excel Calendar Template Payroll Template

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

. Federal Salary Paycheck Calculator. This is the percentage that will be deducted for state and local taxes. This number is the gross pay per pay period.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Discover ADP Payroll Benefits Insurance Time Talent HR More. Payroll So Easy You Can Set It Up Run It Yourself.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary. Starting as Low as 6Month. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

Free salary hourly and more paycheck calculators. The 201920 tax calculator provides a full payroll salary and tax calculations for the 201920 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations. Subtract any deductions and.

Free Unbiased Reviews Top Picks. Free Unbiased Reviews Top Picks. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Heres a step-by-step guide to walk. Discover ADP Payroll Benefits Insurance Time Talent HR More. All Services Backed by Tax Guarantee.

The tax calculator provides a full step by step breakdown and analysis of each. Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay. Salary commission or pension.

Multiply the hourly wage by the number of hours worked per week. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. It will confirm the deductions you include on your.

Ad Compare This Years Top 5 Free Payroll Software. State and local taxes. Get Started With ADP Payroll.

All inclusive payroll processing services for small businesses. The tool then asks you. Get a free quote today.

Get Your Quote Today with SurePayroll. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. For 2019 we take your gross pay minus 4200 per allowance times this percentage to estimate.

Small Business Low-Priced Payroll Service. Ad Process Payroll Faster Easier With ADP Payroll. Get a free quote today.

Ad Process Payroll Faster Easier With ADP Payroll. Then multiply that number by the total number of weeks in a year 52. Ad Accurate Payroll With Personalized Customer Service.

Small Business Low-Priced Payroll Service. 3 Months Free Trial. The standard FUTA tax rate is 6 so your.

Ad Get Started Today with 2 Months Free. 3 Months Free Trial. Starting as Low as 6Month.

How to use a Payroll Online Deductions Calculator. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Ad Compare This Years Top 5 Free Payroll Software.

Get Started With ADP Payroll. You first need to enter basic information about the type of payments you make. It can also be used to help fill steps 3 and 4 of a W-4 form.

Plug in the amount of money youd like to take home.

12 Best Calculator Apps For Android 2021 Investment Banking What Is Flux Investing

Pin On Excel Templates

Excel Payroll Template

The Living Wage Calculator Finds What You Need To Support Your Family Child Support Calculator Child Support Quotes Child Support Payments Child Support Laws

Download Annual Benefit Spend Change Report Excel Template Exceldatapro Excel Templates Brain Facts Benefit

Beautiful Tire Shop Business Card Check More At Https Limorentalphiladelphia Com Tire Shop B Tax Deductions Free Business Card Templates Music Business Cards

Sales Compensation Plan Template Excel Elegant Download Free Sales Missions Calculator Templates

Download Employee Training Log Excel Template Exceldatapro Employee Training Excel Templates Train

Download Adoption Tax Credit Calculator Excel Template Exceldatapro Excel Templates Tax Credits Federal Income Tax

Bi Weekly Schedule Template Luxury 7 Biweekly Payroll Calendar 2015 Template Payroll Calendar Payroll Calendar Template

Sole Proprietor Vs S Corporation In 2019 S Corporation Sole Proprietor Payroll Taxes

Explore Our Example Of Payroll Schedule 2020 Template Payroll Calendar Payroll Calendar Template

How To Prepare Payroll In Excel This Wikihow Teaches You How To Calculate Payroll For Your Employees In Microsoft Excel Creating A Payro Salary Excel Payroll

Payroll System Efficient Way Of Managing Small Business Payroll Payroll Software Payroll Bookkeeping Services

Excel Payroll Template

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Excel Spreadsheets Templates Spreadsheet Template

Sales Compensation Plan Template Excel Beautiful Free Excel Templates For Payroll Sales Mission