Solo 401k contribution calculator

Solo 401k Contribution Calculator Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. The 2020 Solo 401k contribution limits are 57000 and 63500 if age 50 or older.

Self Directed Solo 401k Eligibility Checklist My Solo 401k Financial

The 2022 Solo 401k contribution limit is 61000 and 67500 if age 50 or.

. To remove the PDF. Solo 401 k Contribution Calculator As a self-employed individual we have 2 roles - the business owner and the worker the employer and the employee. To calculate your Solo 401k Plan maximum contribution please input the information in the calculator.

If incorporated and receive a W-2 then use your W-2. To determine your Solo 401k maximum take Employee Contribution Employer Contribution. The employee calculation for a Solo 401k is pretty straightforward.

Use the Individual 401 k Contribution Comparison to estimate the potential contribution that can be made to an Individual 401 k compared to Profit Sharing SIMPLE or SEP plan. Maximum compensation on which contributions can be based is 290000 for 2021 and 305000 for 2022. Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income.

Enter your name age and income and then click. Sole proprietors use your NET income when using the calculator. Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income.

The annual Solo 401k contribution consists of 2 parts a salary deferral contribution and a profit. Important Notes Regarding Using Our Solo 401k Calculator. Enter your name age and income and then click.

The total allowable contribution adds these 2 parts together to get to the maximum Solo 401k contribution limit. The solo 401 k. The maximum Solo 401 k contribution for 2022 may not.

The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. Solo 401 k Contribution Calculator Please note that this calculator is only intended for sole proprietors or LLCs taxed as such. If you are self-employed compensation means earned income.

A PDF document will be created that you can print or save. Maximum Solo 401 k contribution maximum profit sharing contribution maximum salary deferral NOTE. If your business is an S-corp C-corp or LLC taxed as.

Self-employed 401 k calculator - individual 401 k contributions Calculate your earnings and more Self-employed individuals and businesses employing only the owner partners and.

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

Solo 401k Infographics Sense Financial Services Llc

Making Year 2022 Annual Solo 401k Contributions Pretax Roth And Voluntary After Tax A K A Mega Backdoor My Solo 401k Financial

Solo 401k Rules For Your Self Employed Retirement Plan

Retirement Savings Chart Retirement Calculator Retirement Savings Chart Savings Chart

Solo 401k Contribution Limits And Types

Solo 401k Contribution For Partnership And Compensation

Self Directed Solo 401k Process Flowchart Illustration

Solo 401k Contribution Calculator Solo 401k

Solo 401 K A Retirement Plan For The Self Employed Individual Rules Travel Credit Cards Retirement Planning Good Credit

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

Solo 401k Contribution Calculator Solo 401k

Here S How To Calculate Solo 401 K Contribution Limits

Solo 401k Contribution Calculator Solo 401k

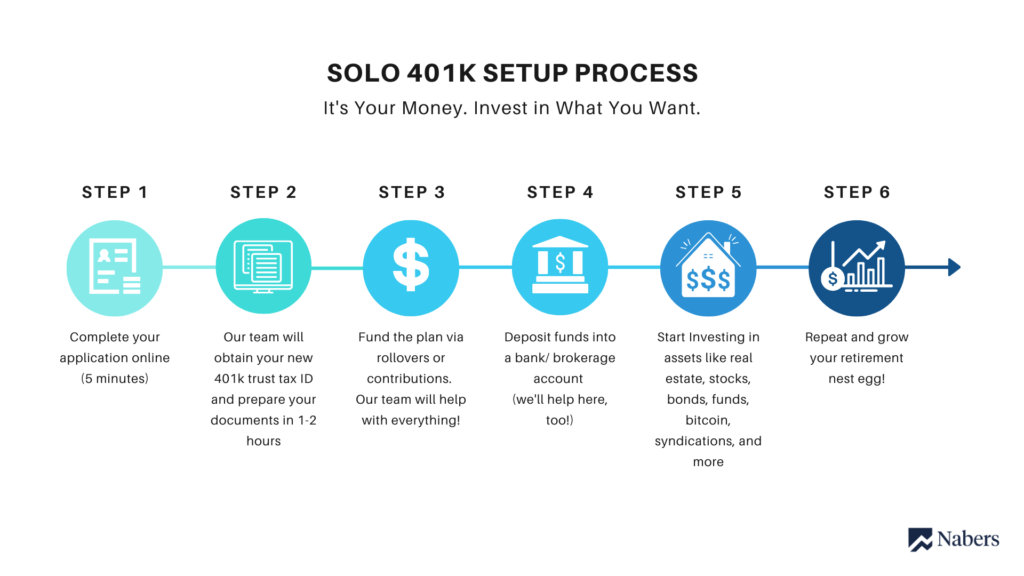

Solo 401k Setup Process Solo 401k

Solo 401k Contribution Limits And Types